Most Used/ Popular microinsurance Products globally

In an increasingly interconnected world where risks are a part of

everyday life, microinsurance has emerged as a vital

tool to protect the vulnerable and financially underserved populations

against unforeseen calamities. Microinsurance

offers affordable coverage tailored to the specific needs of low-income

individuals and communities. Let's delve into

some of the most popular and useful microinsurance products that are

making a positive impact across the globe.

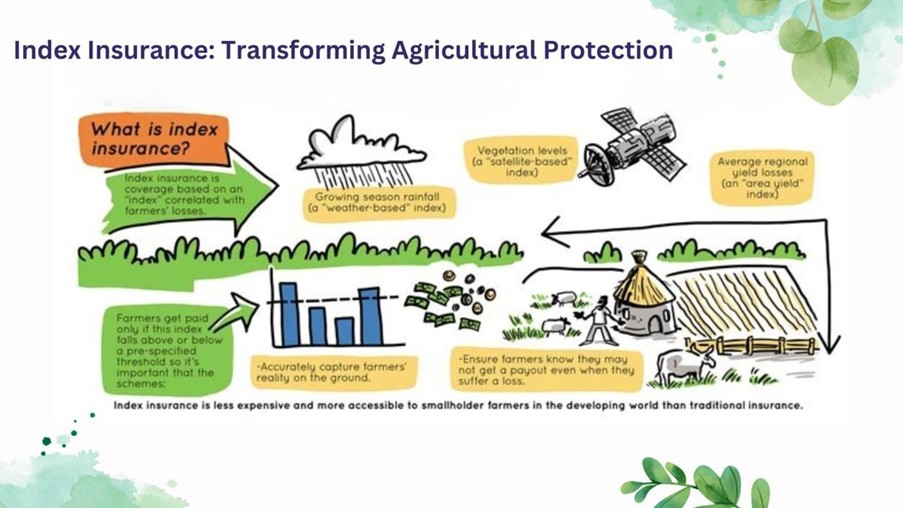

Weather Index-Based Microinsurance

It provides protection to farmers and agricultural workers against

weather-related risks such as droughts, floods, and

hurricanes. Instead of relying on individual loss assessments, payouts are

triggered based on predefined weather

parameters, making the process more efficient and timelier. This product is

particularly crucial in developing countries

where agriculture is a primary source of livelihood.

Health Microinsurance

Health microinsurance schemes provide affordable access to essential

healthcare services, covering expenses such as

hospitalization, surgeries, and outpatient care. These policies are designed

to address the healthcare needs of

low-income families who might otherwise struggle to afford quality medical

treatment.

Life Microinsurance

Life microinsurance policies provide financial security to the families of

policyholders in the event of their demise.

These policies often come with minimal paperwork and affordable premiums,

making them accessible to low-income

individuals. Organizations like Bima in Africa have played a pivotal role in

popularizing life microinsurance by

partnering with mobile network operators to reach remote populations.

Micro credit & Loan insurance

Microcredit and loan insurance products are designed to protect borrowers and

their families in case of unexpected

events, such as disability or death, that could hinder their ability to

repay loans. These policies ensure that

borrowers are not burdened with debt that they cannot repay due to

unforeseen circumstances.

Livestock Microinsurance

For many in rural areas, livestock represents a significant portion of their

assets and income. Livestock microinsurance

safeguards against losses due to disease outbreaks, theft, or natural

disasters. This product not only protects the

livelihoods of pastoral communities but also fosters economic resilience in

agriculture-dependent regions. Examples of

successful livestock microinsurance initiatives can be found in East Africa,

where the International Livestock Research

Institute (ILRI) has implemented such programs.

Property Microinsurance

Property microinsurance covers damage or loss of homes and belongings due to

events like fire, earthquakes, or theft.

These policies are designed to help low-income households recover from

unexpected disasters without falling into a cycle

of debt. In the Philippines, institutions like the Microinsurance MBA

Association of the Philippines have made

significant strides in promoting property microinsurance to protect

vulnerable communities from natural disasters.

Funeral and Burial Microinsurance

Funeral and burial microinsurance products ease the financial burden on

grieving families by covering funeral expenses.

In many cultures, proper burial ceremonies are essential, but they can be

expensive. Funeral microinsurance ensures that

families can provide a dignified farewell to their loved ones without

suffering financial hardship. This product has

seen growth in regions like South Africa & India.

Conclusion

Microinsurance has emerged as a powerful tool to enhance financial inclusion

and provide risk protection to low-income

populations across the world. The popularity of microinsurance products

continues to grow as they address the specific

needs of underserved communities, offering them a safety net against various

risks. These products not only help

individuals and families recover from setbacks but also contribute to

poverty reduction and economic stability in

developing nations.