How Microinsurance is protecting the economically marginalised farmers

Micro insurance is a type of insurance that is designed

to provide

coverage to individuals with low incomes and limited access to

traditional insurance products. Micro insurance has become an

important tool for protecting economically marginalized farmers, who

are often at risk of losing their livelihoods due to crop failures,

natural

disasters, and other unforeseen events. At a very minimal premium

amount, Microinsurance offers financial protection against many

unforeseen situations that may affect these farmers and their

families.

Here are some of the ways that micro insurance is protecting

economically marginalized farmers:

1. Crop insurance: Crop insurance policies protect farmers against

the loss of their crops due to weather-related events such as

droughts, floods, and storms. These policies provide farmers with

financial assistance to help them recover from crop losses and

continue farming.

2. Livestock insurance:The livestock insurance policies protect

farmers against the loss of their animals due to disease, theft, or

other unexpected events. These policies provide farmers with

financial assistance to help them replace their livestock and

continue their livelihoods.

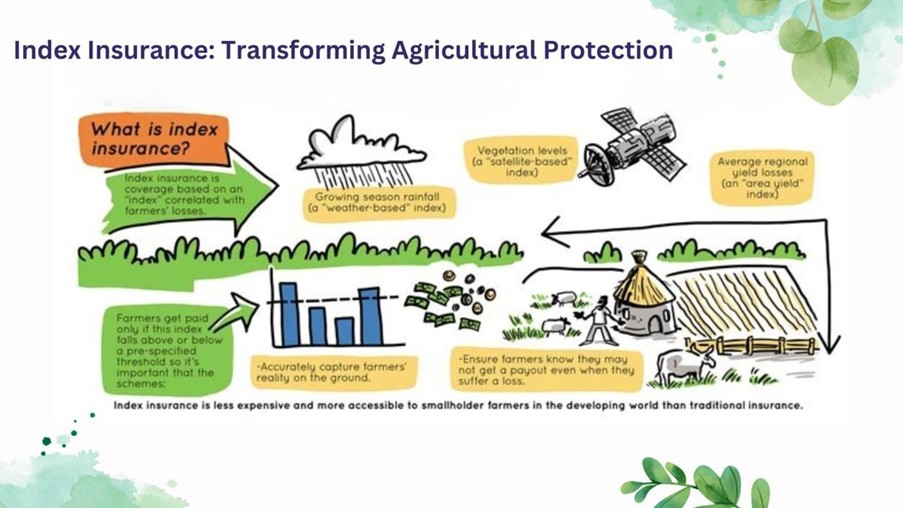

4. Weather index insurance:Some micro insurance providers offer

weather index insurance, which pays out benefits based on

specific weather events that are known to affect crop yields. For

example, if there is a certain amount of rainfall or lack of rainfall

during a particular season, farmers who have weather index

insurance policies will receive pay-outs to help them recover from any

losses.

Overall, micro insurance is an important tool for protecting

economically marginalized farmers, who are often at risk of losing their

livelihoods due to events beyond their control. By providing affordable

and accessible insurance products, micro insurance providers are

helping to create more resilient and sustainable farming communities.

About MicroNsure

MicroNsure is a technology led Microinsurance consulting and distribution

company. We are

committed to bringing financial inclusion to the economically vulnerable

section of our society

by offering simple, hassle-free, and affordable microinsurance solutions.

To know more about our services and products do write to us at

madhulika@micronsure.com

Disclaimer

Insurance is offered by Svojas Insurance Broking and Risk Management Services

Private Limited

(CIN U67120TG2017PTC118828).

IRDAI Broking License Code No. DB 718/17, Certificate No. 627, License

category- Direct Broker

(Life & General), valid till 09/11/2023.

Insurance is the subject matter of the solicitation. Product information is

solely based on the

information received from the insurers. For more details on risk factors,

associated terms and

conditions, and exclusions, please read the sales brochure carefully of the

respective insurer

before concluding a sale.

For more information on Svojas Insurance Brokers visit

www.svojasinsurancebrokers.com