Introduction:

Insurance has long been an essential tool for managing risk, providing individuals and organizations with financial protection against unexpected losses. In agriculture, insurance similarly helps farmers mitigate risks caused by natural disasters, pests, or disease outbreaks. However, traditional agricultural insurance comes with significant challenges:

In this blog, we will delve into the details of the Shopkeepers Insurance Policy, its coverage sections, benefits, exclusions, and why it's essential for retail businesses.

- High costs associated with assessing losses.

- The need for on-site damage assessments, which are both expensive and timeconsuming.

- Indemnities for actual losses may not always be financially viable.

- The risk of basis risk, where payouts may not accurately reflect a farmer’s actual losses.

- Moral hazard, where insured parties may take greater risks due to the financial protection provided.

- The time and resources required for auditing losses after an event.

In many developing countries, these barriers make it difficult for smallholder farmers to access the protection they need. Index insurance offers a solution to these challenges.

What is Index Insurance?

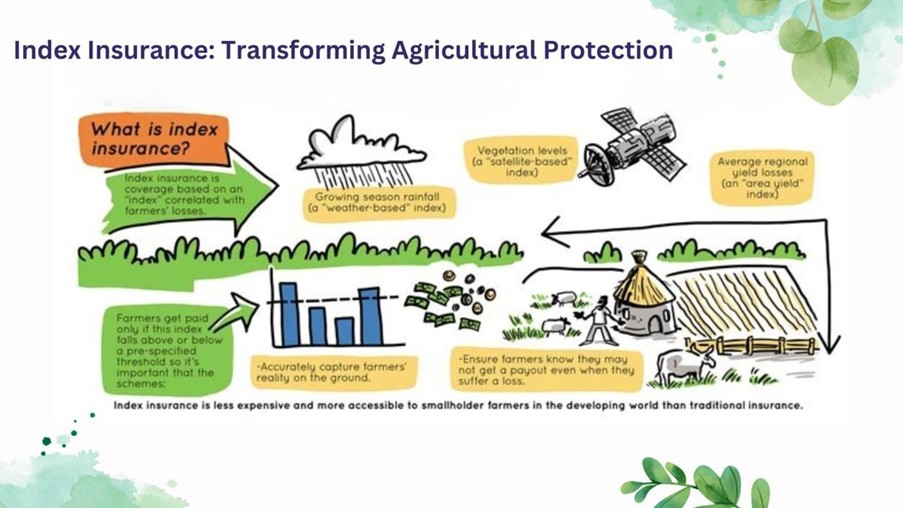

Index insurance is a type of insurance where payouts are determined based on a specific, measurable index, rather than individual loss assessments. Unlike traditional insurance, which evaluates losses on a case-by-case basis, index insurance uses predefined indices—such as rainfall levels, temperature, or crop yield data—to trigger payouts. This approach provides a more affordable, efficient, and accessible way for farmers to manage agricultural risks, particularly in regions prone to unpredictable weather conditions.

The index for Index insurance can be based on but not limited to:

- Rainfall levels

- Temperature

- Crop yield data

- Wind speed or humidity levels

- Livestock mortality rates

The index measures deviations from normal levels of these parameters, triggering payouts when thresholds are exceeded. For example, if rainfall falls below a certain level during the growing season, the farmer receives compensation, regardless of specific crop losses.

Index insurance aims to protect farmers from financial hardship resulting from adverse weather conditions like droughts, temperature extremes, or erratic rainfall patterns— issues that are becoming more frequent due to climate change.

Benefits of Index Insurance

- Quick and Automatic Compensation: Payouts are triggered automatically when the index exceeds a set threshold, offering prompt financial relief to farmers.

- Lower Transaction Costs: By eliminating the need for on-site assessments and claims processing, index insurance reduces administrative costs, lowering premiums and making coverage more affordable.

- Increased Accessibility: With lower premiums and simplified processes, index insurance makes coverage more accessible to low-income farmers who may not be able to afford traditional insurance.

- Reduced Moral Hazard: Index insurance insures against risks that cannot be manipulated by the insured (such as extreme weather), which helps reduce moral hazard typically seen in traditional insurance.

- Efficient Risk Coverage: : Large numbers of people are often affected by extreme weather events at once, making index insurance a more efficient solution to widespread agricultural risks.

- Encourages Financial Resilience: Timely payouts allow farmers to recover quickly from losses, ensuring they can continue farming even after a disaster.

Challenges of Index Insurance

- Variability in Local Losses: While an index may trigger a payout based on overall conditions, individual losses can still vary widely across farmers, making payouts less precise for some.

- Understanding Agricultural Cycles: Effective index insurance requires a deep understanding of local agricultural practices and cycles to ensure that the index accurately reflects actual crop loss.

- Basis Risk: Basis risk occurs when the index doesn’t accurately

reflect the individual farmer’s losses. This can result from poorly

designed indices or geographical factors, such as the distance between

weather stations and the farm.

To minimize basis risk, the index must be robustly designed, incorporating accurate data and localized conditions. Increasing the density of weather stations or satellite data can also help reduce geographical basis risk. - Data and Technological Limitations: The success of index insurance depends on the availability of reliable weather data and technology, such as satellite imagery or weather stations. In some regions, access to such technology may be limited, affecting the effectiveness of index insurance.

Case Studies

Countries like Nigeria, Zambia, Mozambique, Rwanda, Tanzania and Kenya are using index insurance based on satellite weather data. In India, the Ministry of Agriculture launched a weather-based crop insurance scheme in 2016 and introduced Saral Krishi Bima in 2023, an index-based insurance for cattle aimed at addressing the decline in milk production due to rising temperatures.

Conclusion

Index insurance is an innovative approach to risk management, offering an

efficient, affordable, and objective method for protecting farmers against

weather-related losses. By using predefined indices, such as rainfall or

temperature, index insurance enables faster and more transparent claims

processes compared to traditional insurance.

While index insurance is

a promising solution for protecting vulnerable populations from the

financial impacts of climate change, challenges such as basis risk,

affordability, and data availability need to be addressed to maximize its

effectiveness. However, with the right support and technology, index

insurance can significantly enhance the resilience of farmers and rural

communities, ensuring they are better equipped to handle the growing risks

of extreme weather.

In combination with other risk management tools,

like extension services and improved agricultural practices, index insurance

can provide an essential safety net, helping farmers stay financially secure

in the face of increasingly unpredictable weather patterns.

https://documents1.worldbank.org/curated/en/590721468155130451/pdf/662740NWP 0Box30or0Ag020110final0web.pdf https://www.indexinsuranceforum.org/faq/what-index-insurance

About MicroInsurance Innovation Hub Foundation

The Microinsurance Innovation Hub aims to revolutionize the MicroInsurance

segment, especially in India and the Asia Pacific region. Based in

Hyderabad, it focuses on developing inclusive insurance solutions tailored

to underserved populations. By exploring product, technological, and process

requirements, the hub supports interested companies in penetrating this

market segment. With a mission to serve the underprivileged, it strives to

enhance insurance penetration and foster inclusive growth.

The Hub

would work to support the development of micro insurance in the Indian

insurance industry through exploring various aspects of this business, the

product range, the technological requirements, the process requirements, and

the type of people required to enhance penetration.

Disclaimer:

The Microinsurance Innovation Hub is a Section 8 company and has members who intend to foster financial inclusion of underserved and unserved communities through providing Insurance. The innovation hub will act as an open platform to the stakeholders of microinsurance. This Hub will exclusively work in the Microinsurance / Inclusive Insurance space in India and other regions. The information provided here is gathered from various sources and Microinsurance Innovation Hub doesn’t validate any data. The information here are intended solely for internal discussion purposes.