Introduction to Microinsurance: Insurance for Economically vulnerable population

Insurance is an essential investment. Everyone needs to insure themselves and their families against the losses incurred due to unforeseen events. Thanks to technology and digital advancements, awareness about ‘the need for insurance’ has raised over the years. While for most of us living in the urban areas and working under organized sectors, insurance plans like life insurance, motor insurance, health insurance have been a regular part of our investment plans. However, a large insurance protection gap still prevails in the emerging markets and rural areas.

A large population of our society is not covered by traditional insurance plans and social security schemes. This population is vulnerable to the perils like poor health, accidents, natural disasters, disability, or death. Such events can push their families to a never-ending cycle of poverty and hunger.

To overcome this disparity and promote inclusive insurance, the Insurance Regulatory and Development Authority of India (IRDAI), in 2005, created a specific category of insurance called Microinsurance.

What is Microinsurance- Affordable insurance for Economically vulnerable

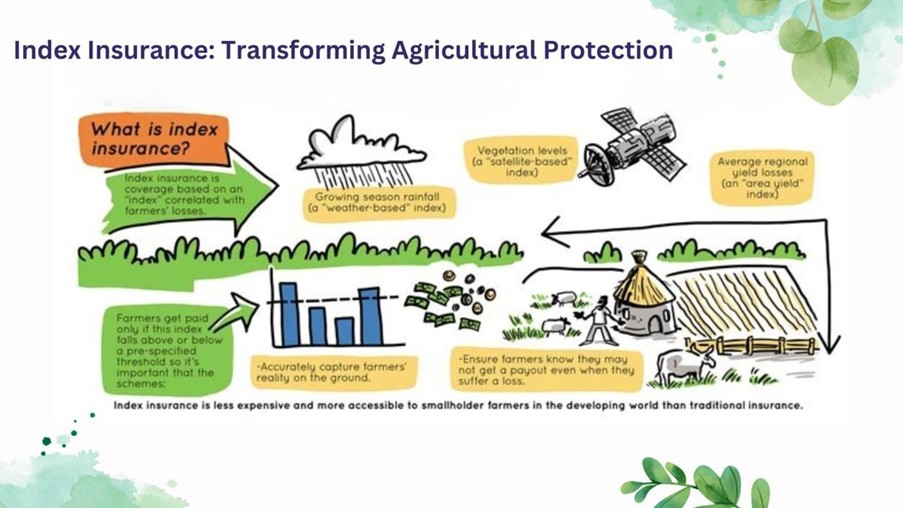

A category of insurance offers tailormade policies catering to the needs of the economically vulnerable population in the developing economies. These policies provide protection and compensation for the health and property risks in exchange for a low premium. The common risk categories covered under these policies include crop insurance, Cattle insurance, health insurance, life insurance, etc., to name a few.

Main features of Microinsurance

The main features that differentiate Microinsurance policies from traditional insurance plans are:

- Microinsurance provides coverage for individuals with low disposable income especially, in developing economies and emerging markets.

- The sum assured offered by the Microinsurance policies is capped at INR 200,000 for Life insurance. Life micro-insurance product are exempted from GST.

- Microinsurance is offered at an affordable price to ensure large-scale participation. An individual has to pay only a small amount as a premium. The premium for the policies can be as low as Rs.50 per month.

- The policies and processes are made simple with minimal documentation.

- Faster claim processing, almost immediately.

Microinsurance is a tool to minimize disparity in insurance protection. It is an opportunity for the economically marginalized population to avail of insurance at a low cost.

Over the years, many traditional insurers have started offering microinsurance policies. These insurers collaborate with the institutions like corporative banks, NGOs, Microinsurance distributors, who work closely with low-income groups to reach the target customers.

Microinsurance is instrumental in bridging the protection gap in India. Technological advances have resulted in significant improvements in the business model. Advanced data collection and interpretation models have improved the overall efficiency by optimizing the cost and time.

However, challenges like reaching the right audience, insurance awareness, and trust, make it a long journey to tap the potential market and achieve inclusive insurance. We still have a long way to go!

Blockchain for Transparency and Trust

Blockchain technology is another game-changer in microinsurance, offering unparalleled transparency, security, and trust in insurance transactions. Recording policy contracts, claims, and transactions on a tamper-proof distributed ledger helps Insurtech companies in eliminating fraudulent activities, reduce processing times, and enhance trust between insurers and policyholders.

About MicroNsure

MicroNsure is a technology led Microinsurance consulting and distribution company. We are committed to bringing financial inclusion to the economically vulnerable section of our society by offering simple, hassle-free, and affordable microinsurance solutions. To know more about our services and products do write to us at madhulika@micronsure.com

Disclaimer

Insurance is offered by Svojas Insurance Broking and Risk Management Services Private Limited (CIN U67120TG2017PTC118828). IRDAI Broking License Code No. DB 718/17, Certificate No. 627, License category- Direct Broker (Life & General), valid till 09/11/2023. Insurance is the subject matter of the solicitation. Product information is solely based on the information received from the insurers. For more details on risk factors, associated terms and conditions, and exclusions, please read the sales brochure carefully of the respective insurer before concluding a sale. For more information on Svojas Insurance Brokers visit www.svojasinsurancebrokers.com