Can Microinsurance mitigate the Impact of climatic change?

Climate change is causing more frequent and severe natural disasters,

such as floods, droughts,

and hurricanes, which can devastate communities and leave people without

homes, crops, and

livelihoods.

Climate change has a significant impact on economically vulnerable

population, particularly those

living in developing countries. The effects of climate change can

exacerbate existing challenges

and create new ones, making it more difficult for people living in

poverty to improve their lives.

Microinsurance can play an important role in mitigating the impacts of

climate change on

vulnerable populations.

“Microinsurance is a category of insurance designed for low-income

individuals and families who

may not have access to traditional insurance products. It provides them

with financial protection

against various risks, including those associated with climate change.

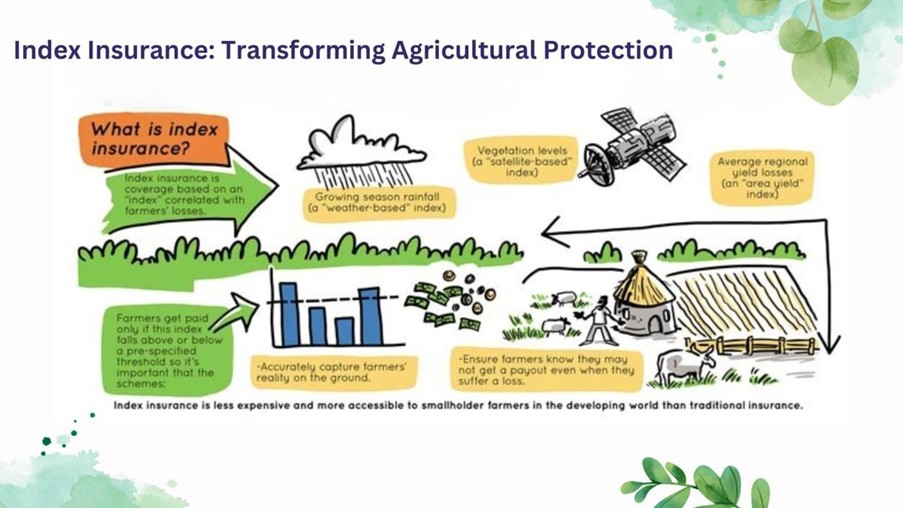

Microinsurance policies can cover losses from weather-related events,

such as crop failure due to drought or damage to

homes and businesses from floods or hurricanes.

Microinsurance can help in mitigating the impact of climate change in

several ways:

1. Protecting vulnerable populations: Climate change often affects

the most vulnerable

populations, such as low-income households and small-scale farmers.

Microinsurance can

provide them with a safety net to protect them from financial losses

caused by climate related disasters like droughts,

floods, or storms.

2. Facilitating post-disaster recovery: In the aftermath of a

climate-related disaster,

microinsurance can help households and communities to recover more

quickly. With

insurance coverage, they can afford to repair or rebuild their homes and

businesses,

replace lost or damaged equipment and livestock, and continue to earn an

income.

3. Supporting adaptation measures: Microinsurance can also support

adaptation measures

that help communities to become more resilient to climate change.

4. Providing Sustenance: During the period of the calamity the

family does not earn an

income as normally the populations are daily wage earners.

Microinsurance can help in

providing funds for basic requirements during a calamity. Overall,

microinsurance can play an important role in addressing the impacts of

climate change

on vulnerable populations. By providing financial protection and

supporting adaptation and

mitigation efforts, microinsurance can help build resilience and reduce

the risk of losses for those

who are most vulnerable to the effects of climate change.

About MicroNsure

MicroNsure is a technology led Microinsurance consulting and distribution

company. We are

committed to bringing financial inclusion to the economically vulnerable

section of our society

by offering simple, hassle-free, and affordable microinsurance solutions.

To know more about our services and products do write to us at

madhulika@micronsure.com

Disclaimer

Insurance is offered by Svojas Insurance Broking and Risk Management Services

Private Limited

(CIN U67120TG2017PTC118828).

IRDAI Broking License Code No. DB 718/17, Certificate No. 627, License

category- Direct Broker

(Life & General), valid till 09/11/2023.

Insurance is the subject matter of the solicitation. Product information is

solely based on the

information received from the insurers. For more details on risk factors,

associated terms and

conditions, and exclusions, please read the sales brochure carefully of the

respective insurer

before concluding a sale.

For more information on Svojas Insurance Brokers visit

www.svojasinsurancebrokers.com