Cancer is a critical global health issue, affecting millions each year and

placing immense burdens on families and healthcare systems. In India,

approximately 1 in 9 people will face a cancer diagnosis in their lifetime,

underscoring the need for tailored health insurance that addresses cancer’s

unique challenges. With millions of cases reported annually, especially among

women, the importance of early detection and a robust healthcare infrastructure

is undeniable. Addressing this crisis requires an integrated approach, combining

awareness, prevention, and accessible financial protection to mitigate cancer's

economic and health impacts.

Reference: Health Insurance Coverage

Disruptions and Cancer Care and Outcomes: Systematic Review of Published

Research

The Global and Indian Context of Cancer

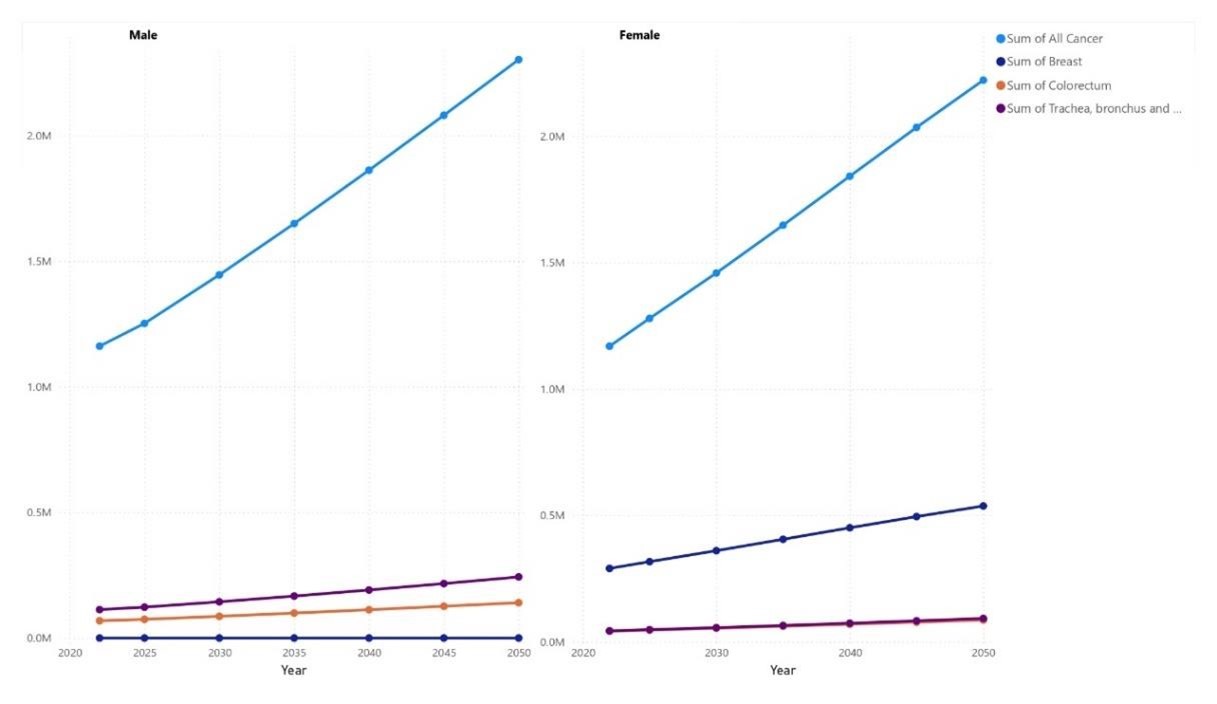

Globally, nearly 20 million new cancer cases were reported in 2022, with approximately 26,300 deaths daily—a number projected to increase by 77% by 2050. Lung cancer remains the most commonly diagnosed type, followed by breast and colorectal cancers, with lung cancer alone accounting for 2.5 million cases and 1.8 million deaths.

In India, rising cancer incidence has become a major public health challenge. In 2022, cases were estimated between 1.9 and 2 million, though the actual number may be higher due to underreporting. Cancer cases in India have doubled since 1990 and are projected to rise, with an estimated 1.57 million new cases annually by 2025. Many of these cases are detected at later stages, resulting in lower survival rates and substantial economic strain on families. These statistics highlight the urgent need for proactive prevention measures and financial preparedness.

India is experiencing an acute public health challenge due to steadily rising cancer incidence rates. Many of these cases are detected at late stages, resulting in lower survival rates and significant economic losses. The rising numbers emphasize the need for proactive measures, including both prevention and financial preparedness.

Reference: Cancer incidence estimates for 2022 & projection for 2025: Result from National Cancer Registry Programme, India

Raising Awareness: Prevention and Early Detection

Awareness campaigns are essential in promoting early detection and preventive habits. Initiatives like Breast Cancer Awareness Month play a vital role by educating the public about self-examinations and risk-reducing lifestyle choices, including maintaining a healthy weight, avoiding alcohol and tobacco, and following a balanced diet. Early detection significantly improves treatment outcomes and reduces the overall impact on both individuals and healthcare systems.

Critical Illness Insurance – A ray of hope to mitigate cancer risks!

While awareness is vital, financial protection through critical illness insurance is equally important. Cancer-specific policies provide essential support, covering treatment costs so that families can focus on recovery without excessive financial stress.

Consider these examples:

Case 1: Meet Mr. Rajesh

Case 2: Meet Mr. Dave

These cases highlight how insurance can reduce economic stress, complementing public awareness by providing a financial safety net.

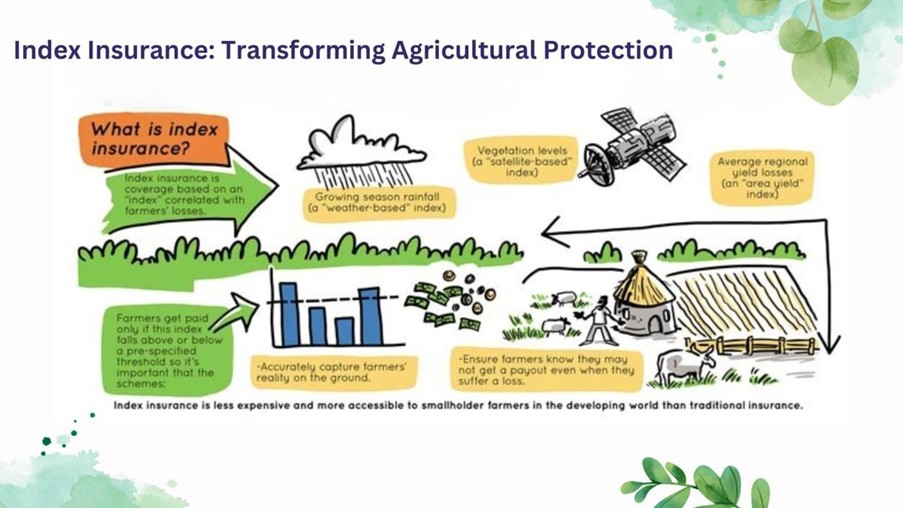

Innovative Solutions: Sachet-Style Insurance:

For underserved communities, traditional insurance can be prohibitively expensive. Sachetstyle insurance, an innovative model, offers affordable, limited-coverage policies. This approach provides essential financial protection and is accessible through digital platforms, making it feasible for those who may otherwise lack insurance.

Key Considerations for Effective Cancer Care Insurance

A comprehensive cancer care insurance plan should consider:

MicroNsure's Impact: Accessible Coverage for All

MicroNsure, a leader in microinsurance, launched a sachet-style critical illness insurance product in 2023, providing coverage for 8 million lives across India, with 5.5 lakh individuals specifically covered for 11 common critical illnesses, including cancer. This initiative demonstrates how affordable, targeted insurance can bring financial security to underserved communities.

Covered Critical Illnesses: Cancer (Specified Severity), Heart Attack, Coronary Artery Bypass Graft, Stroke, Kidney Failure, Major Organ Transplant, Permanent Paralysis of Limbs, Motor Neuron Disease, Coma, and Multiple Sclerosis. Coverage starts at ₹25,000.

For more details, reach out to MicroNsure at support@micronsure.com or visit www.micronsure.com.

| 11 critical illnesses | Cancer (Specified Severity), Heart Attack (Myocardial Infarction), Coronary Artery Bypass Graft (CABG), Stroke (Resulting in Permanent Symptoms), Kidney Failure (Requiring Regular Dialysis), Major Organ Transplant, Permanent Paralysis of Limbs, Motor Neuron Disease, Coma (of Specified Severity), Multiple Sclerosis (with Persisting Symptoms). |

|---|---|

| Coverage | Starts with 25,000 |

Conclusion

As cancer rises, accessible and specialized insurance solutions become increasingly important. Cancer insurance plans can provide essential financial protection, and innovative models like sachet-style coverage may expand access to underserved populations. By combining early detection, awareness, and financial protection, the healthcare sector can better support those affected by cancer, safeguarding both quality of life and economic stability.

References:

- 1. World Cancer Report - Cancer research for cancer prevention by IACR 2020

- 2. Health Insurance Coverage Disruptions and Cancer Care and Outcomes: Systematic Review of Published Research

- 3. Cancer incidence estimates for 2022 & projection for 2025: Result from National Cancer Registry Programme, India

- 4. India's Cancer Burden Drives Generational Poverty by think global health

- 5. Breast Cancer Facts and Statistics by American Cancer Society

- 6. Breast Cancer Awareness Month - October2024

- 7. Breast Cancer Risk Factors – PAGE HOSPITALS

- 8. Top 10 Cancer States in India | 2023 Cancer Statistics in India

About MicroInsurance Innovation Hub

The Microinsurance Innovation Hub aims to revolutionize the MicroInsurance segment, especially in India and the Asia Pacific region. Based in Hyderabad, it focuses on developing inclusive insurance solutions tailored to underserved populations. By exploring product, technological, and process requirements, the hub supports interested companies in penetrating this market segment. With a mission to serve the underprivileged, it strives to enhance insurance penetration and foster inclusive growth.

The Hub would work to support the development of micro insurance in the Indian insurance industry through exploring various aspects of this business, the product range, the technological requirements, the process requirements, and the type of people required to enhance penetration.

Disclaimer:

The Microinsurance Innovation Hub is a Section 8 company and has members who intend to foster financial inclusion of underserved and unserved communities through providing Insurance. The innovation hub will act as an open platform to the stakeholders of microinsurance. This Hub will exclusively work in the Microinsurance / Inclusive Insurance space in India and other regions. The information provided here is gathered from various sources and Microinsurance Innovation Hub doesn’t validate any data. The information here are intended solely for internal discussion purposes.