MicroNsure: Technology-driven, affordable insurance for Unserved & Under-served

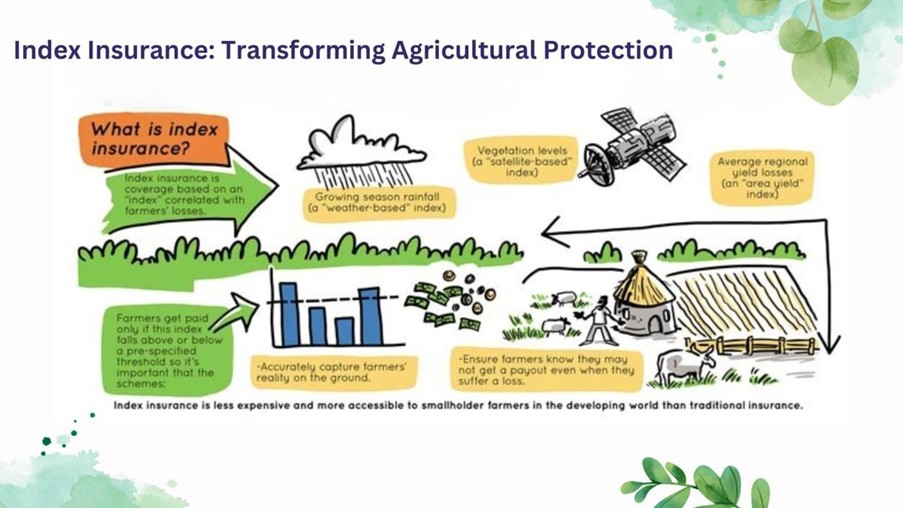

The Great Indian Ocean Tsunami was one of the catastrophes that worst impacted human society in the last 50 years. Surprisingly, the impact of this disaster on the insurance industry was relatively small compared to its global effect. One of the reasons for this was that the most affected areas by Tsumani belonged to developing countries. The losses that occurred to lives and properties were of low economic value. Many of them were uninsured! Time and again, such calamities highlight the need for insurance, particularly amongst the economically marginalized population residing in the emerging markets. The lack of suitable and affordable insurance products presents significant growth opportunities for microinsurance schemes.

Importance of Technology in Microinsurance business

Technology has the power to change the world. However, technology is not a solution in itself, but a vital tool to make insurance accessible, accurate, affordable for those who need it the most. Technology can extend the reach of insurers, helping them build a more resilient society. The key areas where technology is making a positive impact on the industry. 1. The access to new data enables better product design and accurate risk pricing. 2. Automation and standardization of repetitive processes result in efficient and faster processes. 3. Technology can facilitate reduced paperwork, immediate policy issuance, and faster claim processing. 4. Reduced distribution cost 5. Attaining greater cost efficiency and increased profitability.

MicroNsure: Technology-driven, effective, and affordable microinsurance solutions

Considering the fast-paced technological developments, we at MicroNsure rely on technology to create value for all stakeholders. We believe technological advances can lead to sustainable, efficient, and profitable solutions. Harnessing the technological innovations is a must for tapping the potential microinsurance market. Our business model combines three essential aspects of the Microinsurance supply chain 1. Helping partners design sustainable products and processes 2. Help in the distribution of the product 3. Technology support for our partners to help them function smoothly.

Our In-house proprietary technology helps our customers and partners to manage the processes smoothly without any glitches. Some of the key features of our technology platforms include: 1. Uniform view/ format across all the platforms 2. Multilingual system to cater to regional population 3. Integrated system with the core product 4. High volume system 5. Quicker product launches 6. Learning and training management system 7. Agile claims processing platform 8. Zero paper platform 9. Mobile platform for sale & service

About MicroNsure

We are a leading technology-driven microinsurance consultancy and distribution company in India. We are committed to bringing financial inclusion with affordable and sustainable insurance solutions using technology innovation.

To partner with us or to know more about our services. Reach out to