More than 90% of the Indian population does not enjoy any social protection. This leads to uninsured economic losses and losses of Lives. The Pandemic has further widened this gap owing to job losses and movement of Labour. Although some categories like health insurance are picking up, this spurt is limited to the middle class and above, leaving the most vulnerable population still uninsured and exposed to the risk. Owing to the huge protection gap that exists in India and other emerging markets, the Microinsurance sector has great potential. The reach and awareness of Microinsurance have increased thanks to a sharp increase in the number of players and a great deal of innovation in new product development and service delivery. However, in India, as in many other countries, the sector is yet to realize its potential. Some of the main challenges are:-

Key Challenges faced by the Microinsurance sector in India

1. Lack of knowledge & awareness

Lack of overall financial literacy is a significant challenge that affects the perception of insurance products and the trust they enjoy. Insurance is not considered an essential mechanism for long-term risk protection. Awareness needs to be created about the role of insurance in offering protection against unforeseen events. There is also a need to build trust and improve financial literacy among rural and lower-income group populations to improve penetration

2. Trust

Considering the fast-paced technological developments, we at MicroNsure rely on technology to create value for all stakeholders. We believe technological advances can lead to sustainable, efficient, and profitable solutions. Harnessing the technological innovations is a must for tapping the potential microinsurance market. Our business model combines three essential aspects of the Microinsurance supply chain 1. Helping partners design sustainable products and processes 2. Help in the distribution of the product 3. Technology support for our partners to help them function smoothly.

3. Inaccessibility & claim settlement issues

Inaccessibility could be due to factors such as complicated documentation, affordability, or lack of resources. Many individuals in this target group do not possess the documentation required for insurance issuance and claims. Mismatch in name or other data such as age can result in claim settlement issues. and affect the service standards.

4. High business acquisition Cost and servicing

The micro-financing delivery cost is significantly high, due to smaller transactions. Due to the lower volume of policies delivered, the fixed cost remains high. Regulation on commissions in the insurance sector also affects the ability of insurance providers to find distributors. There is a need to pay attention to developing sustainable and affordable need-based products that are economically viable for the business.

5. High rate of policy lapses

Failure to pay the premium on time might result in Policy lapses. This not only leads to loss of risk coverage but also a loss of the amount paid previously as a premium.

6. Absence of need based products

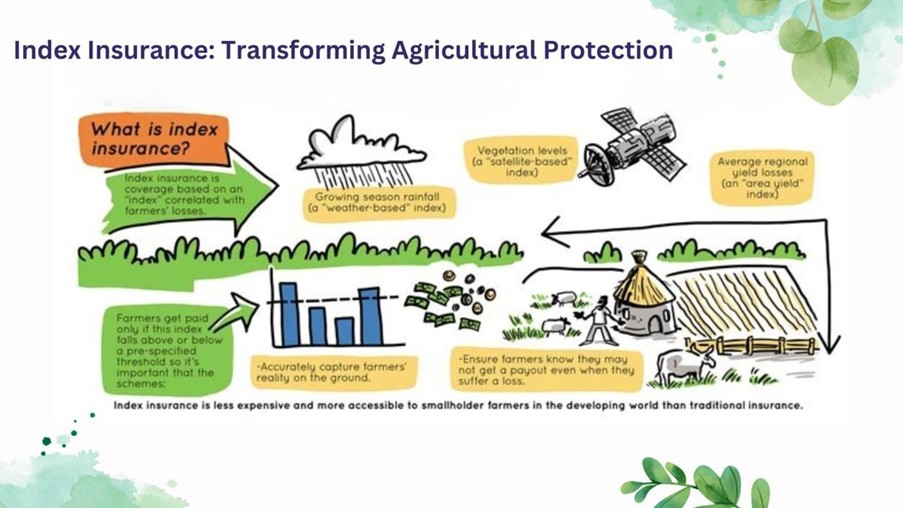

The insurance need for low-income groups especially in the rural areas is vastly different from that of urban areas. There is a dearth of need-based, affordable and customised products for the microinsurance market.For this segment, customized product offerings including crop protection, farming machinery, property, etc are required.

How customer analytics can help the Microinsurance sector

The use of technology has been changing the Microinsurance landscape through customization of repetitive processes, improved accuracy, and efficiency. Furthermore, the new-age analytics tools can convert customer data into business intelligence which can help in more accurate risk calculations and better risk management. Predictive analytics is reshaping the insurance industry by changing the ways of its works. Below are how customer analytics help insurers and their customers.

1.The increased availability of potentially relevant data and its analysis results in more accurate models especially in the fields like agriculture, climate impact, etc.

2.It helps underwriters calculate the optimal course by considering insights.

3.Policyholders who are better informed about their risks can proactively acquire the appropriate insurance coverage.

MicroNsure: Making microinsurance more sustainable and affordable with the help of technology

MicroNsure is one of India’s fastest-growing technology-driven microinsurance consultancy and distribution companies. We harness the potential of technology and apply technological innovations to design more affordable, simple, and sustainable processes. Our Proprietary technology has helped our partners in

- Lowering the acquisition cost via more targeted marketing

- Reducing the expense ratio from higher customer retention

- Lowering the loss ratio from risk prevention due to more informed clients and partners

- Enhancing profitability by enabling paperless operations, faster issuance, and claim to process.

Today technological advancements have the power to overcome challenges faced by the microinsurance sector today and make financial inclusion for all a reality.