Introduction

In today’s evolving financial landscape, mutual funds have gained popularity for their wealthbuilding potential. Traditionally seen as an investment tool for the middle and upper classes, mutual funds can also serve as a powerful vehicle for financially underserved populations, particularly low-income families. This blog will discover how Micro SIPs (Systematic Investment Plans) provide a pathway to financial inclusion, improving the economic stability of the unserved and underserved.

What are Mutual Funds?

Mutual funds pool money from many investors and invest it in a variety of financial instruments, such as stocks, bonds, and other securities. Managed by professional fund managers, these funds offer individuals, regardless of their financial expertise, an opportunity to invest in a diversified portfolio with relatively lower risk.

- In a mutual fund:

Micro SIPs: Empowering the Underserved with Small Steps

Micro SIPs are a form of SIP that enables individuals to invest small, manageable

amounts into mutual funds regularly. Unlike traditional SIPs, which often

require higher minimum contributions, Micro SIPs lower the threshold to as

little as ₹100 per month, with SEBI’s ₹250per-month option also available. The

goal is to foster financial inclusion and wealth creation among underserved

populations by breaking down barriers to financial markets.

By lowering

investment barriers and expanding access to financial markets, this innovative

approach is set to transform the landscape of personal finance, bringing

significant benefits to those previously excluded from formal investment

avenues.

Why Micro SIPs Matter:

Financial Inclusion: Opening Doors to Wealth Creation

Financial inclusion is a crucial part of India’s economic development strategy, and Micro SIPs play a vital role in making it a reality. By offering a low-cost entry point, these plans:

Empowerment through Wealth Creation

Micro SIPs aren't just about saving—they empower wealth creation. By leveraging the power of compounding and rupee cost averaging, small but consistent investments can grow significantly over time. This provides individuals in underserved communities with the chance to build wealth for long-term goals like education, healthcare, and retirement.

Lower Investment Threshold

Traditional SIPs often pose financial challenges for low-income individuals due to their higher minimum investment requirements. Micro SIPs, however, reduce the starting investment to as little as ₹100 or ₹250 per month. This accessible entry point:

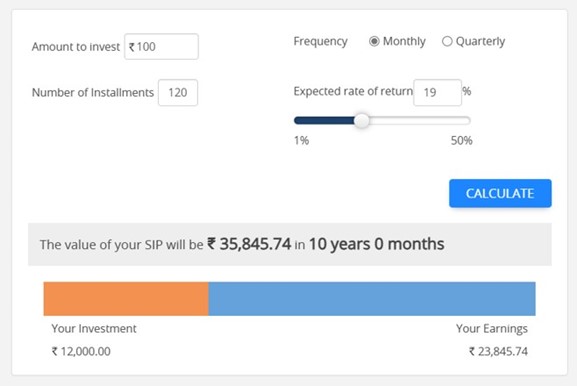

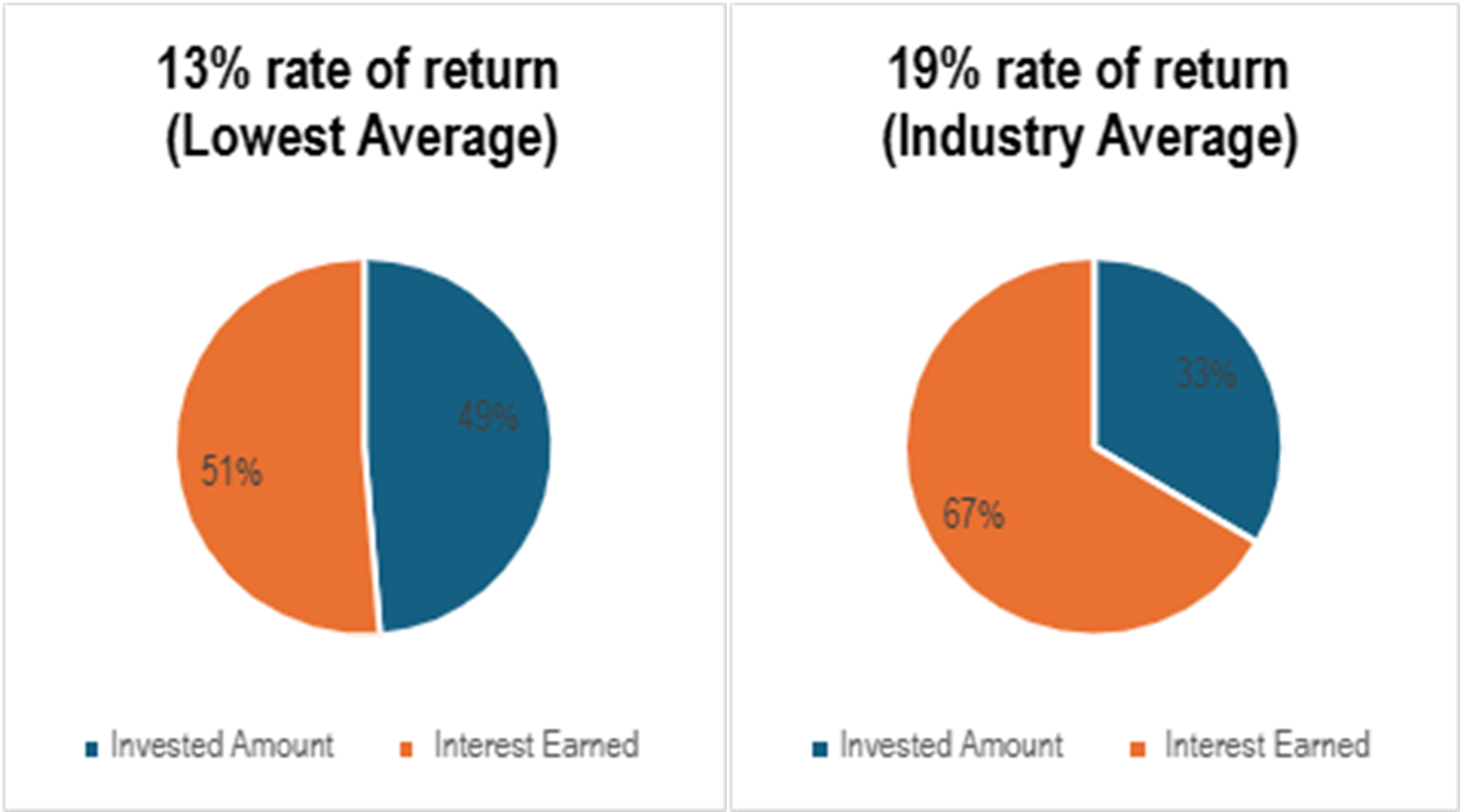

For example, investing ₹100 per month over 10 years at a 13% return rate could

yield ₹24,668, compared to ₹35,846 at a 19% return rate.

(Source:

HDFC SIP Calculator)

| Micro SIP | SIP Amount | Year | Rate of return | Total SIP Amount | Accumulated Amount | Interest Earned |

|---|---|---|---|---|---|---|

| 100 | 10 | 13% | 12000 | 24,668 | 24,668 | |

| 100 | 10 | 19% | 12000 | 35,846 | 23,846 |

Challenges to Accessing Mutual Funds for Low-Income Individuals

While Micro SIPs offer enormous potential, several challenges still hinder the

poor from accessing mutual funds:

1.Lack of Awareness: Many low-income families are unaware of mutual funds and

their benefits. Financial literacy programs are crucial to educate and empower

potential investors.

2.Fear of Risk: Due to their financial instability, low-income individuals are often risk averse. Educating them on different types of funds, such as low-risk debt funds, could help mitigate these fears.

3.Limited Access: The distribution of mutual funds through banks or digital platforms is inaccessible to many, especially in rural areas. Partnerships with microfinance institutions and fintech firms can bridge this gap.

4.Regulatory Barriers: KYC norms requiring PAN cards present obstacles for many

in rural areas. Using alternative identification like Aadhaar or voter IDs could

enable broader participation.

Exploring alternatives like Aadhaar or voter IDs for the KYC process could open

the doors for broader participation, though it is time taking process for

implementing but this could get a huge access for outreach and including this

segment into risk mitigation umbrella

Case Studies: Mutual Funds Changing Lives

Several successful examples from around the world demonstrate how mutual funds can change the lives of poor communities:

These examples highlight the potential of mutual funds in contributing to poverty alleviation when combined with financial education and inclusive access.

Models for Financial Inclusion

Micro SIP’s success depends on implementing effective models that broaden financial inclusion. Some key strategies include:

(Source- Investment Saving Options for the Poor - Indian Wealth Management)