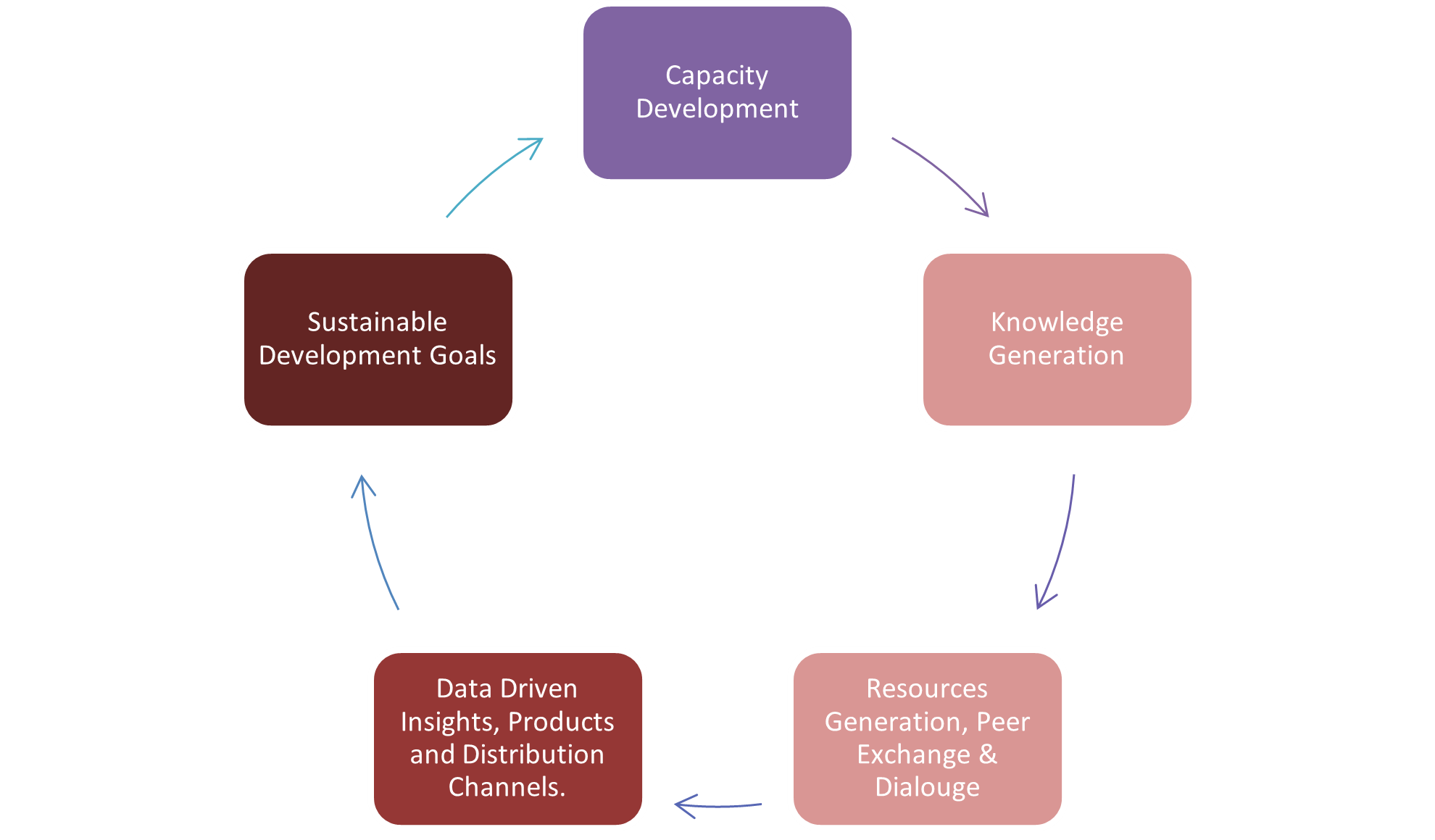

Capacity

Development

Capacity-building exercises to identify the

gaps, need assessment and identifying solutions.

Strengthening the capacity of various stakeholders through learning, sharing, and

training

events.

Knowledge

Generation

To provide suitable information to

stakeholders

a manner that promotes greater understanding

and access to Insurance products, processes, and technology.

Resource

Generation, Peer Exchange, and Dialogue

To facilitate peer exchange and dialogue

between various stakeholders and intermediaries in

the form of study, review notes, briefings, case studies, articles, blogs, and

newsletters.

Data Driven Insights, Products and Distribution Channels

Data-driven decision-making is at the core

of

our research methodologies and the Innovation

Hub would provide innovative data techniques to generate strategic and actionable

insights.

Sustainable Development Goals set by UNDP

Insurance has a critical role to play in

helping vulnerable people around the world manage their risks. It is the same in India.

Development experts should realize that Insurance is a critical enabler to attain many

of the UN’s Sustainable Development Goals (SDG’s). As a financial shock absorber and an

enabler of economic activity, insurance is most effective when complemented by risk

reducing strategies and measures that help prevent losses to make insurance solutions

more accessible, affordable, and sustainable.

The innovation hub would work on 6 major SDGs to end poverty, promote good health and

well-being, provide opportunities for quality education, enhance industry innovation,

creating lasting partnerships and reduce inequalities.